Rock Rail and ASI together have already successfully financed and procured modern train fleets for three UK rail networks – a total investment of £2 billion. The new joint venture (JV) will draw on that expertise to focus on private financing solutions tailored for rail networks in Continental Europe and Scandinavia.

In the UK, Rock Rail and ASI have been credited with transforming the market for the procurement of trains (known in the industry as ‘rolling stock’). The ‘Rock ASI’ approach has generated a new large-scale source of rolling stock funding, allowing pension funds and insurance companies to work with the private sector to help modernise the UK’s rail infrastructure. This has driven increased competition and new investment into the sector, which in turn will deliver a superior service for rail passengers and better value for the government and tax payers.

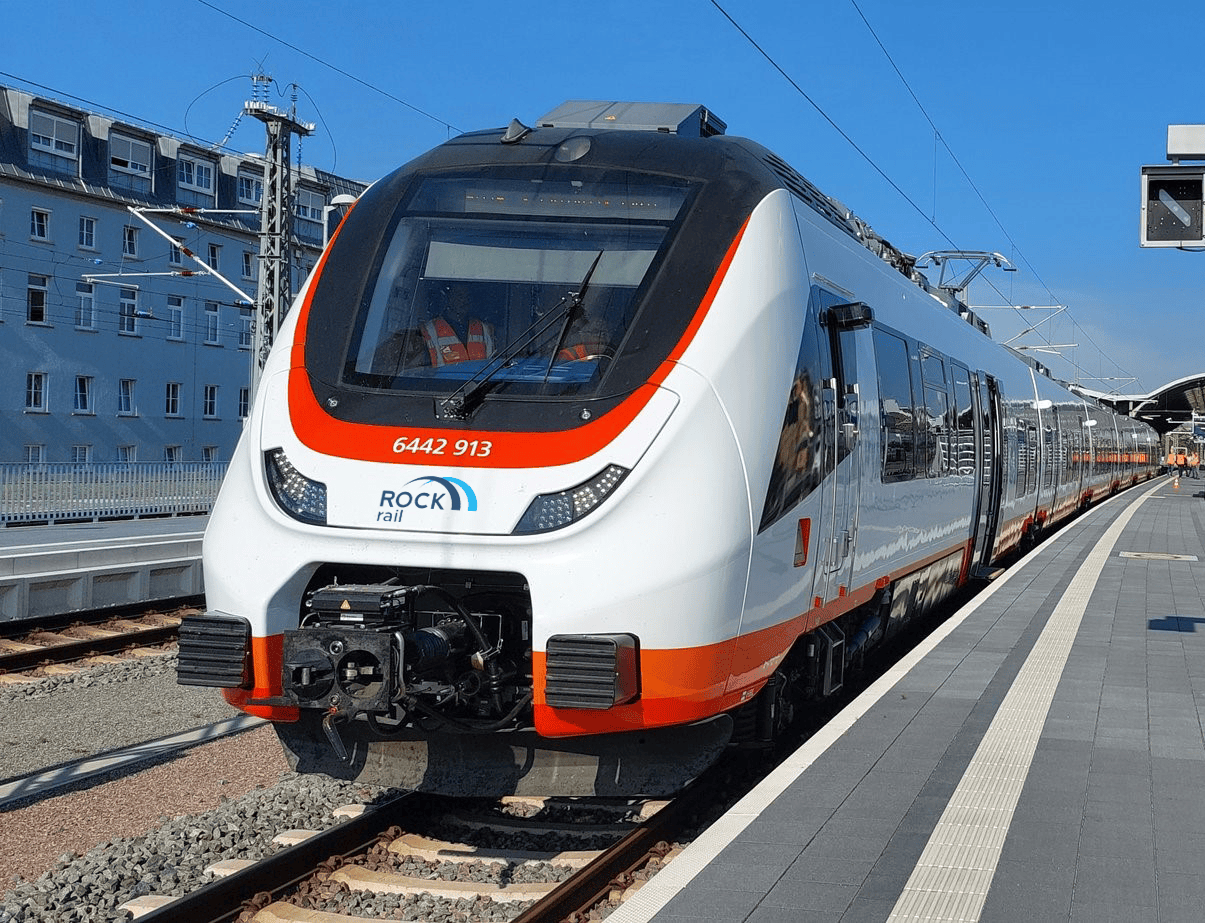

In Europe, many rail networks are state-owned and operated, but there is a definite move towards a more competitive environment for the purchase, funding and operation of train fleets. At the same time, with greater demands on public finances, and minimal private sector investment to date, many countries need to establish alternative sources of funding for their infrastructure – including rolling stock and railways.

New EU initiatives are also driving changes in the railway sector, creating more opportunities for innovative private financing models. The recent ‘European Railway Fourth Package’ will start to come into effect in 2019. This will see EU members open up their domestic rail services to new entrants, making competitive tendering compulsory for all public service rail contracts in the EU.

However there are major differences in how each European country operates its railways, such as levels of state regulation, degrees of market competition and liberalisation, age of train fleets, extent of network electrification, and technical standards. Regional variations also exist within each country. One size will not fit all, but this will suit Rock ASI’s flexible approach to financing train fleets on an individual basis, tailored to meet specific country and regional needs.

In addition to the financing, procurement and leasing activities delivered by the Rock ASI JVs, Rock Rail also provides specialist asset management services for the Rock ASI owned fleets. With a focus on managing long term asset value, the company has a team of specialists covering all aspects of design, construction, delivery, and ongoing operations.

Mark Swindell Rock Rail CEO said:

“We have big ambitions in Europe. The opportunity is here to develop the right train investment and ownership model tailored to individual countries and rail networks. We aim to deliver enhanced value to both the public sector and passengers, bringing in new direct long-term investment from the institutional sector, which has investment time frames, liabilities and return requirements that are closely aligned to rolling stock as an asset class.

“Rock Rail and Aberdeen Standard Investments together are uniquely placed to draw on our experience in redefining the rules of engagement in the UK and to build on our existing strong relationships across both the rail industry and institutional investment sector.

“We know the appetite for European market investment exists amongst our established equity and debt funder community and we are delighted to be extending our partnership with Aberdeen Standard Investments to develop innovative bespoke procurement solutions for European rolling stock and to deliver new sources of investment into the European rail infrastructure market.”

ASI will provide the funding from its infrastructure equity funds such as SL Capital Infrastructure Fund II managed by a 14 strong team, led by Dominic Helmsley.

Dominic Helmsley, head of economic infrastructure, Aberdeen Standard Investments, stated:

“Extending our partnership with Rock Rail will allow us to continue our journey in the rail industry, and access a much wider opportunity set within Europe for our infrastructure funds and clients.

“The infrastructure investing team has worked successfully with Rock Rail in the UK, together building effective relationships with rail operators, manufacturers and government bodies. Both organisations can now take those skills and experience to Europe to create new financing solutions for European rail networks.

“The Rock ASI model will support the passenger rail industry, helping it to expand and modernise across Europe as an essential and environmentally-friendly mode of transport. For pension funds and insurance companies invested in our infrastructure funds, this fits with our strategy to invest in core assets which aim to provide long-term stable returns.”